Open Item Management

At the month end we make the provision. At the time of payment we adjust the provision. If excess payment is made, difference between actual payment and provision is considered as expenditure for that month. This is used for Vendors, Customers and Balance sheet items where clearing is required. We have to select the open item management check box while creating the G/L accounts

We can view the account in 3 ways:-

a. Open items (payable)

b. Cleared items (paid)

c. All items (payable + paid)

Three scenarios for Open Item Management

1) Full Clearing

2) Partial Clearing

3) Residual Clearing

RESIDUAL CLEARING

Steps:

1) Rent Provision (tr code F-02)

2) Outgoing payment with Residual clearing Method (tr code F-07)

3) View Open Items and Cleared Items (tr code FBL3N)

4) Make Payment of Balance Amount (tr code F-07)

5) Checking Open Items and Cleared items after Payment (tr code FBL3N)

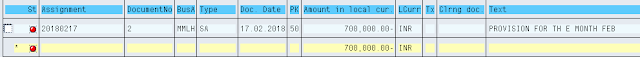

Rent Provision

Path: Accounting - Financial Accounting - General Ledger - Posting - General Posting (Transaction code is F-02)

Step 1) Populate the following fields: Document Date, Type, Company Code, Reference, Posting Key and Account

Press enter

Note:

Reference refers bill number of Vendors or Customers

Step 2) Populate the following fields: Amount, Business Area, Text, Posting key and Account in the next screen and press enter

Step 3) Populate the following fields: Amount, Business Area and Text

Press Enter

Step 4) From the menu select Document - Simulate and save

We get a message below Document was posted in company code

Outgoing Payment using Residual Clearing Method

Path: Accounting - Financial Accounting - General Ledger - Posting - Outgoing Payments (Transaction code is F-07)

Step 1) Populate the following fields: Document Date, Type, Company Code, Reference, Clearing text, Account under Bank data, Business Area, Amount, Text, Account under open item selection and Account type

Select Process open items

Step 2) Place cursor on the amount against which we want to adjust

Step 3) Select the Residual payment tab it creates Residual Items column

Double click on net amount

Double click on residual items amount

Amount entered and Assigned should be the same

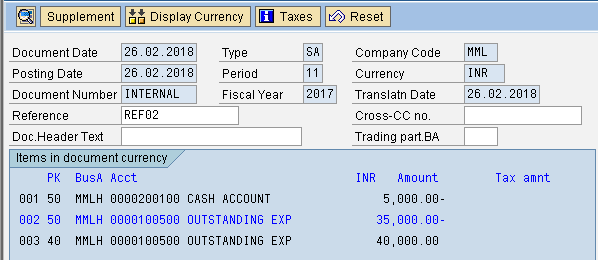

Step 4) From the menu select Document - Simulate

Double click the blue font line item

Populate the Text field and select save button

We get message Document was posted in company code

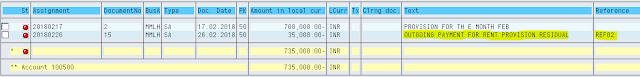

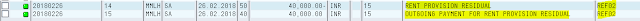

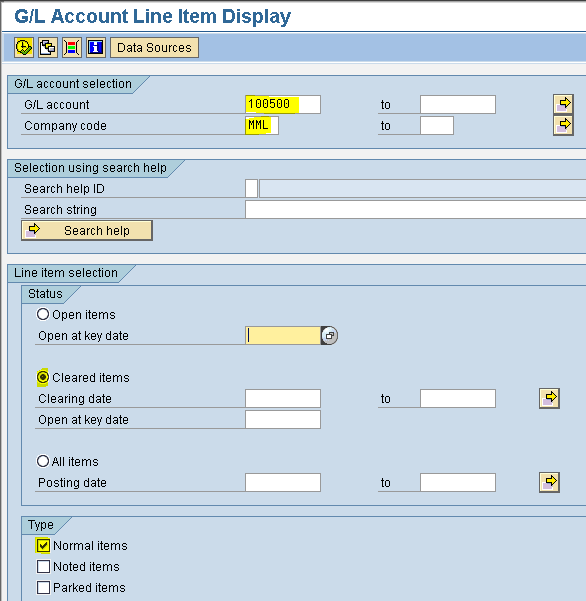

View Open Items and Cleared Items

Path: Accounting - Financial Accounting - General Ledger - Account - Display/Change Line Items (Transaction code is FBL3N)

Step 1) Give G/L account and Company code

Select Open items radio button and Normal items check box

Execute

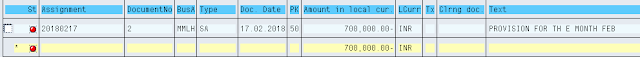

Go back and select the cleared items radio button

Make Payment of Balance Amount 35000/- (Tr. code is F-07)

Step 1) Populate the following fields: Document Date, Type, Company Code, Reference, Clearing text, Account under Bank data, Business Area, Amount, Text, Account under open item selection and Account type

Select Process open items

Step 2) Double click on balance amount 35000/- under the Residual tab

Step 3) From the menu Document - Simulate and save

We get message below Document was posted in company code

View Open Items and Cleared Items after Payment (Tr. code is FBL3N)

Step 1) Give G/L account and Company code

Select Cleared items radio button and Normal items check box

Execute

Verification: Press the back arrow and select Open Items radio button

and select Open Items radio button

Execute

We don't find rent provision because it is cleared

At the month end we make the provision. At the time of payment we adjust the provision. If excess payment is made, difference between actual payment and provision is considered as expenditure for that month. This is used for Vendors, Customers and Balance sheet items where clearing is required. We have to select the open item management check box while creating the G/L accounts

We can view the account in 3 ways:-

a. Open items (payable)

b. Cleared items (paid)

c. All items (payable + paid)

Three scenarios for Open Item Management

1) Full Clearing

2) Partial Clearing

3) Residual Clearing

RESIDUAL CLEARING

Steps:

1) Rent Provision (tr code F-02)

2) Outgoing payment with Residual clearing Method (tr code F-07)

3) View Open Items and Cleared Items (tr code FBL3N)

4) Make Payment of Balance Amount (tr code F-07)

5) Checking Open Items and Cleared items after Payment (tr code FBL3N)

Rent Provision

Path: Accounting - Financial Accounting - General Ledger - Posting - General Posting (Transaction code is F-02)

Step 1) Populate the following fields: Document Date, Type, Company Code, Reference, Posting Key and Account

Press enter

Note:

Reference refers bill number of Vendors or Customers

Step 2) Populate the following fields: Amount, Business Area, Text, Posting key and Account in the next screen and press enter

Step 3) Populate the following fields: Amount, Business Area and Text

Press Enter

Step 4) From the menu select Document - Simulate and save

We get a message below Document was posted in company code

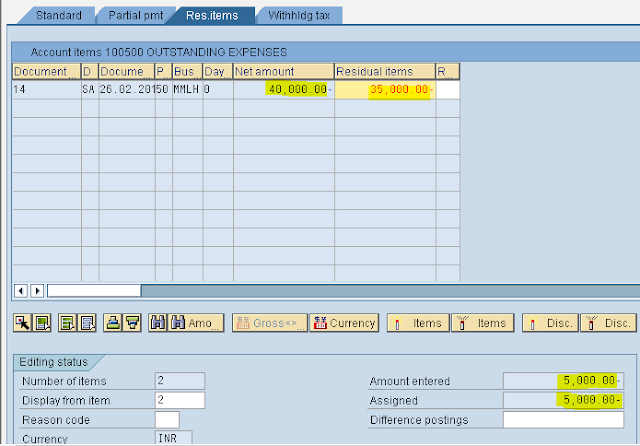

Outgoing Payment using Residual Clearing Method

Path: Accounting - Financial Accounting - General Ledger - Posting - Outgoing Payments (Transaction code is F-07)

Step 1) Populate the following fields: Document Date, Type, Company Code, Reference, Clearing text, Account under Bank data, Business Area, Amount, Text, Account under open item selection and Account type

Select Process open items

Step 2) Place cursor on the amount against which we want to adjust

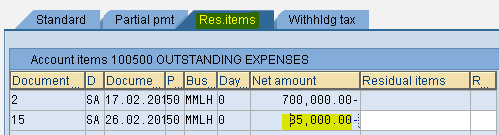

Step 3) Select the Residual payment tab it creates Residual Items column

Double click on net amount

Double click on residual items amount

Amount entered and Assigned should be the same

Step 4) From the menu select Document - Simulate

Double click the blue font line item

Populate the Text field and select save button

We get message Document was posted in company code

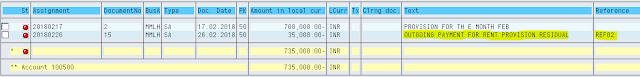

View Open Items and Cleared Items

Path: Accounting - Financial Accounting - General Ledger - Account - Display/Change Line Items (Transaction code is FBL3N)

Step 1) Give G/L account and Company code

Select Open items radio button and Normal items check box

Execute

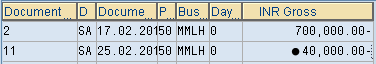

Open Item View

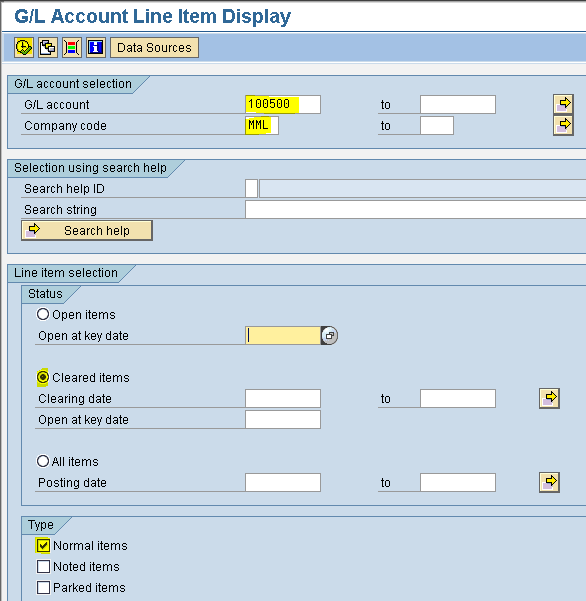

Go back and select the cleared items radio button

Cleared Item View

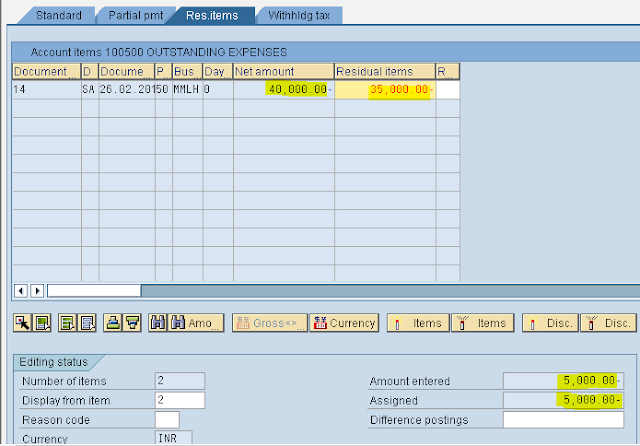

Make Payment of Balance Amount 35000/- (Tr. code is F-07)

Step 1) Populate the following fields: Document Date, Type, Company Code, Reference, Clearing text, Account under Bank data, Business Area, Amount, Text, Account under open item selection and Account type

Select Process open items

Step 2) Double click on balance amount 35000/- under the Residual tab

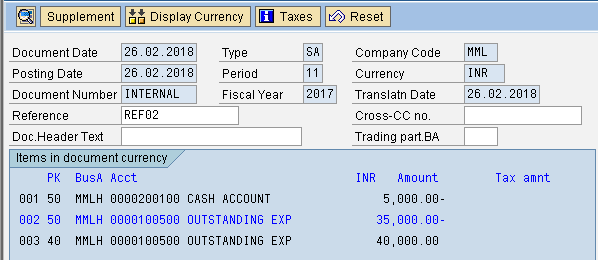

Step 3) From the menu Document - Simulate and save

We get message below Document was posted in company code

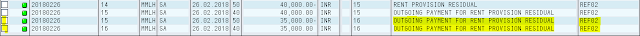

View Open Items and Cleared Items after Payment (Tr. code is FBL3N)

Step 1) Give G/L account and Company code

Select Cleared items radio button and Normal items check box

Execute

Cleared Item View

Verification: Press the back arrow

and select Open Items radio button

and select Open Items radio buttonExecute

We don't find rent provision because it is cleared