Interest Calculation

We have 2 types in SAP

1) Balance Interest Calculation (S)

2) Item Interest Calculation (P)

Balance Interest Calculation (S) - Useful for General Ledger Accounts.

Item Interest Calculation (P) - Useful for Vendors/Customers Accounts.

Customization of Balance Interest Calculation

1. Define Interest Calculation Type

2. Prepare Account Balance Interest Calculation

3. Define Reference Interest Rates

4. Define Time Dependent Terms

5. Enter Interest Values

6. Creation of G/L Accounts

7. Assignment Accounts for Automatic Postings

End User Area:

1. SBI rupee term loan receipt

2. Term loan repayment

3. Balance Interest Calculation

4. Interest Rates Changed

5. Balance Interest Calculation (when rate changed)

6. Interest Postings to Accounts (one month)

7. To view the Document Posted

8. Go and see the G/L master

Define Interest Calculation Type

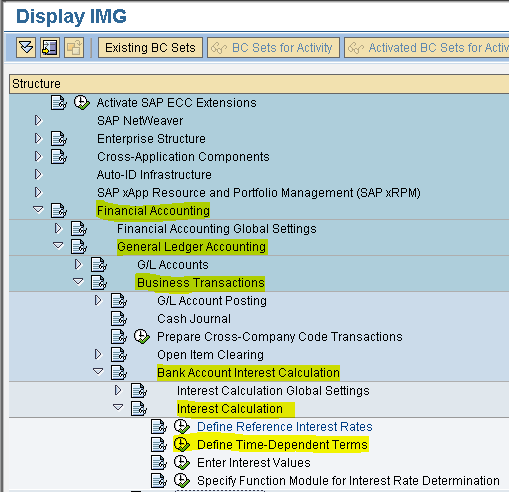

Path: SPRO - Select SAP Reference IMG - Financial Accounting - General Ledger Accounting - Business Transactions - Bank Account Interest Calculation - Interest Calculation Global Settings - Define Interest Calculation Types (Transaction code is OB46)

In the SAP Reference IMG select the menu path

Step 1) Select New Entries button

Step 2) Populate the following fields: Interest Indicator, Name and the Interest Calculation Type

Step 3) Select save button we see message below

we see message below

Prepare Account Balance Interest Calculation

Path: SPRO - Select SAP Reference IMG - Financial Accounting - General Ledger Accounting - Business Transactions - Bank Account Interest Calculation - Interest Calculation Global Settings - Define Interest Calculation Types (Transaction code is OBAA)

Step 1) Select New Entries button

Step 2) Populate the following fields: Interest calculation indicator, Interest calculation frequency and calendar type

Select balance plus interest check box

Note:

Calendar type - "G" for Rupee Term Loans

Calendar type - "F" for Foreign currency Loans

Step 3) Select save button we get message below

we get message below

Define Reference Interest Rates

Step 1) Select New Entries button

Step 2) Populate the following fields: Reference interest rate, Long text, Description, Date from and Currency

Step 3) Select save button we get message below

we get message below

Step 4) Select next entry button in the same screen

in the same screen

Populate the following fields: Reference interest rate, Long text, Description, Date from and Currency

Step 5) Select save button we get message below

we get message below

Define Time Dependent Terms

Path: SPRO - Select SAP Reference IMG - Financial Accounting - General Ledger Accounting - Business Transactions - Bank Account Interest Calculation - Interest Calculation - Define Time - Dependent Terms (Transaction code is OB81 )

Step 1) Select New Entries button

Step 2) Populate the following fields: Interest calculation indicator, Currency key, Effective from, Sequential number, Terms select from drop down menu and Reference interest rate (M2)

Step 3) Select save button we get message below

we get message below

Step 4) Select next entry button in the same screen.

button in the same screen.

Populate the following fields : Interest calculation indicator, Currency key, Effective from, Sequential number, Terms select from drop down menu and Reference interest rate (M3)

Step 5) Select save button we get message below

we get message below

Enter Interest Values

Path: SPRO - Select SAP Reference IMG - Financial Accounting - General Ledger Accounting - Business Transactions - Bank Account Interest Calculation - Interest Calculation - Enter Interest Values (Transaction code is OB83 )

Step 1) Select New Entries button

Step 2) Populate the following fields: Reference (M2, M3), Valid from and Interest rate

Step 3) Select save button we get message below

we get message below

Creation of G/L Accounts

A. SBI Rupees term loan - Secured loan group (100300 - 100399)

B. Interest Account - Interest group (400400 - 400499)

To check account group for the accounts to be created follow the following path (transaction code is OBD4)

Step 1) In the next screen scroll down to find the position button and click on it

Step 2) Enter the company code that we defined previously

Press Enter

Now we can find the Account Group, name, From Account and To Account details of the G/L accounts to be created

G/L Creation (Use Transaction code - FS00)

A. SBI Rupees term loan

Step 1) Give the G/L account number, Company code and press With Template button in order to create a new G/L account with reference to another G/L account

Step 2) Enter the G/L (Equity share capital ) and Company code

Press enter

Step 3) Change the Account group to Secured Loans, change the short and long text.

Select Create/bank/interest tab

Step 4) Field status group change to G005

Interest Indicator select M1

Step 5) Select save button we get message below

we get message below

B. Interest Account

Step 1) Give the G/L account number, Company code and press With Template button in order to create a new G/L account with reference to another G/L account

Step 2) Enter the G/L (Salaries Account ) and Company code

Press enter

Step 3) Select Type/Description tab

Change the Account group to Interest, change the short and long text

Other fields common

Step 4) Select save button we get message below

we get message below

Assignment Accounts for Automatic Postings

Path: SPRO - Select SAP Reference IMG - Financial Accounting - General Ledger Accounting - Business Transactions - Bank Account Interest Calculation - Interest Posting - Prepare G/L Account Balance Interest Calculation (Transaction code is OB83 )

Step 1) Select the Symbols button

Step 2) Note interest paid - 0002 and G/L account (paid) - 2000

Select Accounts button

Step 3) Give the Chart of Accounts MML and press enter

Step 4) Populate the following fields: Account symbol, Currency and G/L Account

Note: 10 times + means any account number

Why 10 times + (plus) if we are using 6 digits for G/L account? Why not use ++++++ (6 times plus) ? Because even though G/L is 6 digits sap adds four zero to make it 10 digits Example : 400400 ( 0000400400)

Step 4) Select save button we get message below

we get message below

End User Area

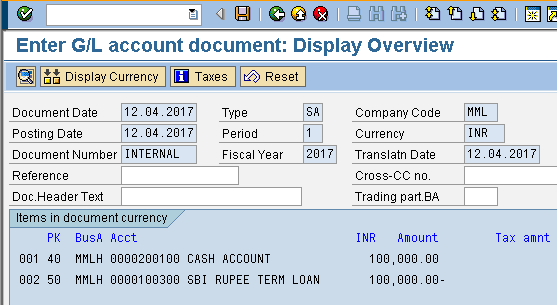

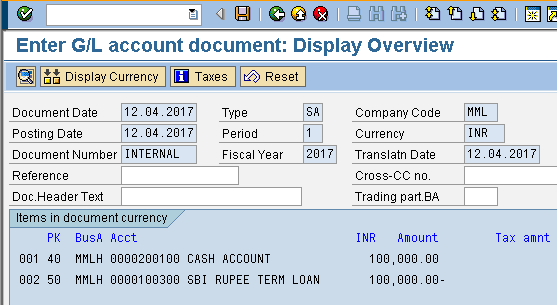

SBI rupee term loan receipt - (F-02)

SBI cheque date 10.04.2017

cheque deposit in bank 12.04.2017

Document and Posting date 12.04.2017

Interest calculation in SAP from 12.04.2017

whereas bank calculates from 10.04.2017

we are giving value date 10.04.2107

Now Sap also calculates interest from 10.04.2018

Step 1) Populate the following fields: Document Date, Type, Company Code, Period, Currency and Posting key. Select the G/L account from the drop down button and press enter

Step 2) Populate the following fields: Amount, Business Area, Value date, Text, Posting key, Account in the next screen and press enter

Step 3) Populate the following fields: Amount, Business Area, Value date, Text in the next screen and press enter

Step 4) From the menu select document and press simulate to view the document details

Step 5) Select save button we get message below

we get message below

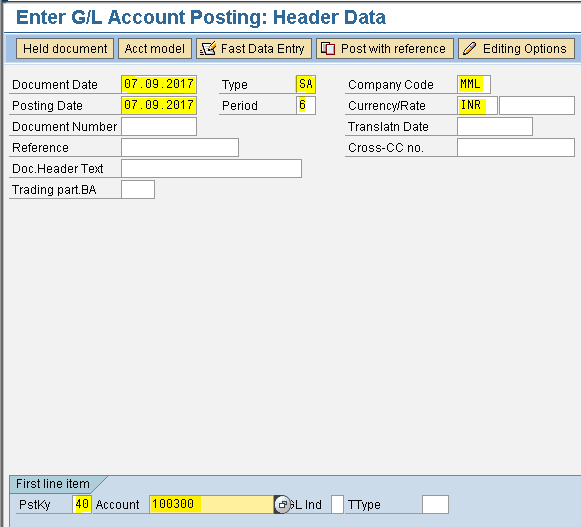

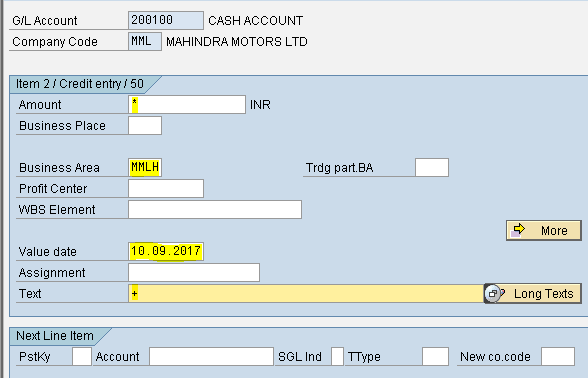

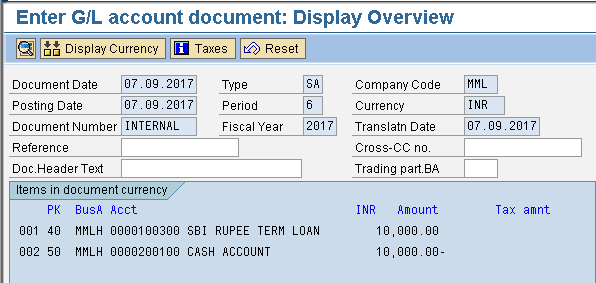

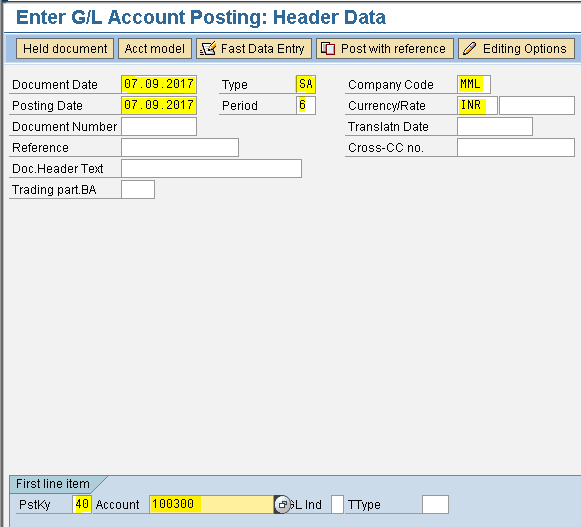

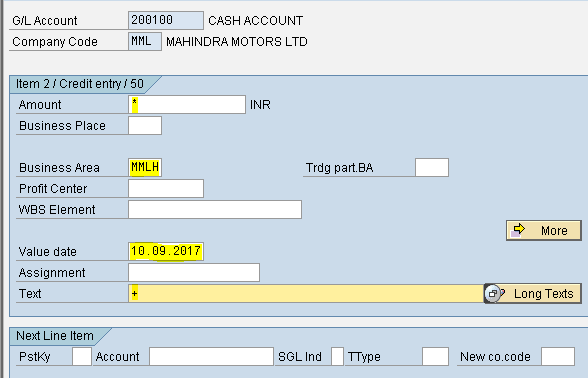

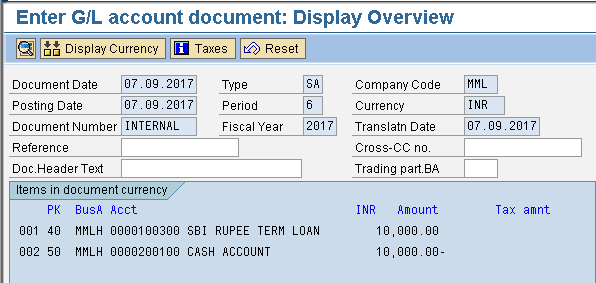

Term loan repayment (Use t.code f-02)

Due date 10.09.2017

Cheque date 07.09.2017

Value date 10.09.2017

Document and Posting date 07.09.2017

Step 1) Populate the following fields: Document Date, Type, Company Code, Period, Currency and Posting key. Select the G/L account from the drop down button and press enter

Step 2) Populate the following fields: Amount, Business Area, Value date, Text, Posting key, Account in the next screen and press enter

Step 3) Populate the following fields: Amount, Business Area, Value date, Text in the next screen and press enter

Step 4) From the menu select document and press simulate to view the document details

Step 5) Select save button we get message below

we get message below

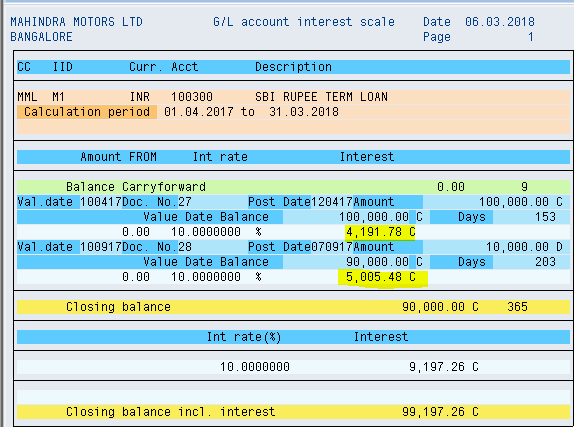

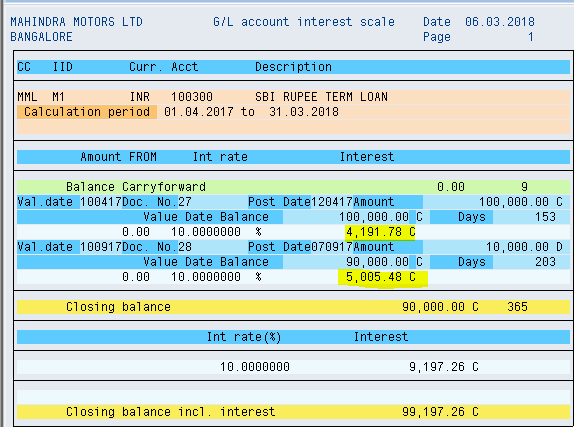

Balance Interest Calculation

Path: Accounting - Financial Accounting - General Ledger -Periodic Processing - Interest Calculation - Balance Interest Calculation (Transaction code is f.52)

Populate the following fields: Chart of Accounts, Company code, G/L account and Calculation period Select additional balance line check box

Execute

Here we view Interest rate and Interest

(100000*10%*153/365 days = 4,191.78

90000*10%*203/365 days = 5,005.48)

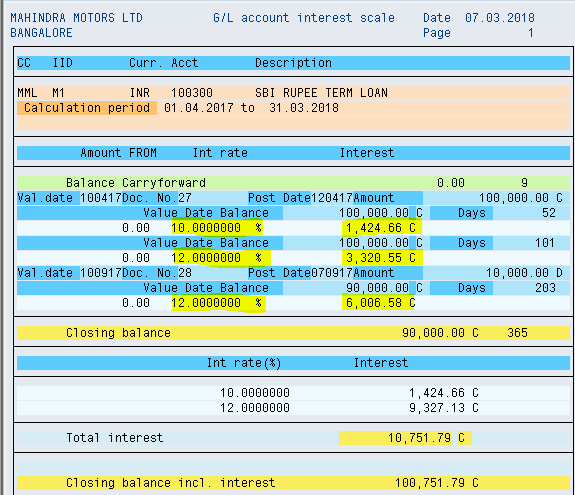

Interest Rates Changed

Interest rate change from 10% to 12% from 01.06.2017

On 100000 from 10.04.2017 to 31.05.2017 @ 10%

On 100000 from 01.06.2017 to 09.09.2017 @ 12%

On 90000 form 10.09.2017 to 31.03.2018 @ 12%

Enter Interest rate(new) - (transaction code is OB83)

Step 1) Select New Entries button

Step 2) Populate the following fields: Reference, Valid from and Interest rate

Step 3) Select save button we get message below

we get message below

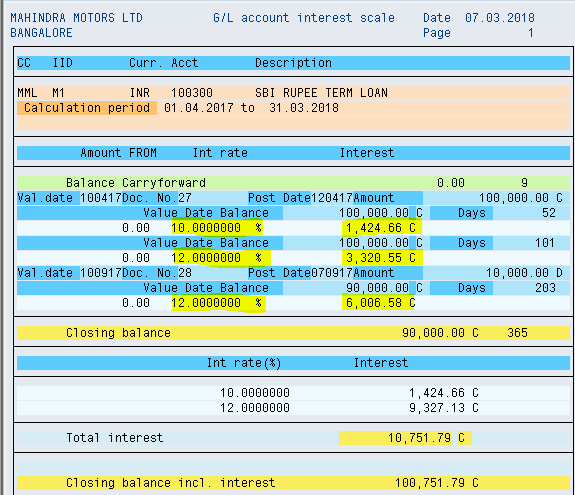

Balance Interest Calculation (when rate changed)

(transaction code is f.52)

Populate the following fields : Chart of Accounts, Company code, G/L account and Calculation period Select additional balance line check box

Execute

Here we view Interest rate and Interest

(100000*10%*52/365 days = 1,424.66

100000*12%*101/365 days = 3320.55

90000*12%*203/365 days = 6006.58)

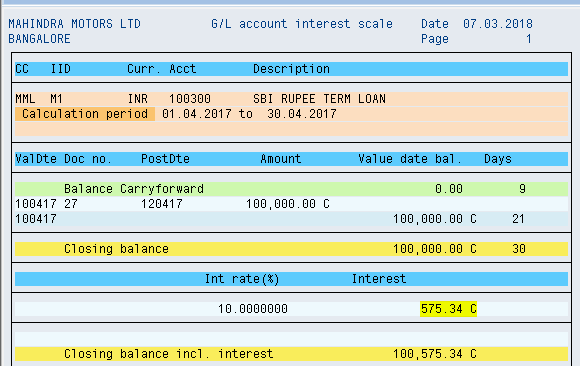

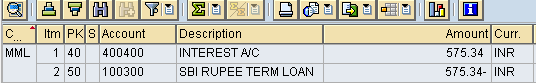

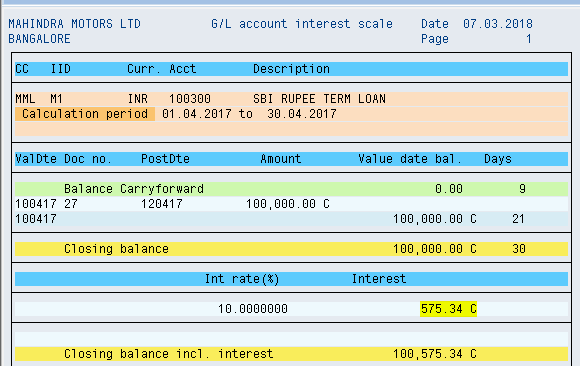

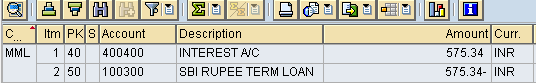

Interest Postings to Accounts (one month) (Transaction code is f.52)

Step 1) Populate the following fields: Chart of Accounts, Company code, G/L account and Calculation period

Select Post interest settlements check box and update master records check box

Session name :MML

Posting to business area : MMLH

Posting date of session : 30.04.2017

Posting segment text : Interest for April 2017

Select Execute button

Here we can see Interest for a month (100000*10%*21/365 days)

Step 2) To view the batch Input session From the menu select System - Services - Batch input - Session

Step 3) Select the Session name and press process button

Step 3) Select the Session name and press process button

Step 4) Select Display errors only radio button and press process button

Step 5) We get message Processing of batch input session completed

To view the Document Posted (Use transaction code - FB03)

Go and see the G/L master (Transaction code is FS00)

Step 1) Give G/L account and company code

Select Display button

Step 2) Select Create/bank/interest tab

Here we see Key date of last interest calculation and Date of last interest run

We have 2 types in SAP

1) Balance Interest Calculation (S)

2) Item Interest Calculation (P)

Balance Interest Calculation (S) - Useful for General Ledger Accounts.

Item Interest Calculation (P) - Useful for Vendors/Customers Accounts.

Customization of Balance Interest Calculation

1. Define Interest Calculation Type

2. Prepare Account Balance Interest Calculation

3. Define Reference Interest Rates

4. Define Time Dependent Terms

5. Enter Interest Values

6. Creation of G/L Accounts

7. Assignment Accounts for Automatic Postings

End User Area:

1. SBI rupee term loan receipt

2. Term loan repayment

3. Balance Interest Calculation

4. Interest Rates Changed

5. Balance Interest Calculation (when rate changed)

6. Interest Postings to Accounts (one month)

7. To view the Document Posted

8. Go and see the G/L master

Define Interest Calculation Type

Path: SPRO - Select SAP Reference IMG - Financial Accounting - General Ledger Accounting - Business Transactions - Bank Account Interest Calculation - Interest Calculation Global Settings - Define Interest Calculation Types (Transaction code is OB46)

Step 1) Select New Entries button

Step 2) Populate the following fields: Interest Indicator, Name and the Interest Calculation Type

Step 3) Select save button

we see message below

we see message belowPrepare Account Balance Interest Calculation

Path: SPRO - Select SAP Reference IMG - Financial Accounting - General Ledger Accounting - Business Transactions - Bank Account Interest Calculation - Interest Calculation Global Settings - Define Interest Calculation Types (Transaction code is OBAA)

Step 1) Select New Entries button

Step 2) Populate the following fields: Interest calculation indicator, Interest calculation frequency and calendar type

Select balance plus interest check box

Note:

Calendar type - "G" for Rupee Term Loans

Calendar type - "F" for Foreign currency Loans

Step 3) Select save button

we get message below

we get message belowDefine Reference Interest Rates

- Interest Rates are given to Reference Interest Rate

- Reference Interest Rates are assigned separately (Accounts with credit balance M2 and Accounts with debit balance M3)

- Accounts with debit and credit balances are assigned to INTEREST INDICATOR - M1 ( that we defined )

Step 1) Select New Entries button

Step 2) Populate the following fields: Reference interest rate, Long text, Description, Date from and Currency

Step 3) Select save button

we get message below

we get message belowStep 4) Select next entry button

in the same screen

in the same screenPopulate the following fields: Reference interest rate, Long text, Description, Date from and Currency

Step 5) Select save button

we get message below

we get message belowDefine Time Dependent Terms

Path: SPRO - Select SAP Reference IMG - Financial Accounting - General Ledger Accounting - Business Transactions - Bank Account Interest Calculation - Interest Calculation - Define Time - Dependent Terms (Transaction code is OB81 )

Step 1) Select New Entries button

Step 2) Populate the following fields: Interest calculation indicator, Currency key, Effective from, Sequential number, Terms select from drop down menu and Reference interest rate (M2)

Step 3) Select save button

we get message below

we get message belowStep 4) Select next entry

button in the same screen.

button in the same screen.Populate the following fields : Interest calculation indicator, Currency key, Effective from, Sequential number, Terms select from drop down menu and Reference interest rate (M3)

Step 5) Select save button

we get message below

we get message belowEnter Interest Values

Path: SPRO - Select SAP Reference IMG - Financial Accounting - General Ledger Accounting - Business Transactions - Bank Account Interest Calculation - Interest Calculation - Enter Interest Values (Transaction code is OB83 )

Step 1) Select New Entries button

Step 2) Populate the following fields: Reference (M2, M3), Valid from and Interest rate

Step 3) Select save button

we get message below

we get message belowCreation of G/L Accounts

A. SBI Rupees term loan - Secured loan group (100300 - 100399)

B. Interest Account - Interest group (400400 - 400499)

To check account group for the accounts to be created follow the following path (transaction code is OBD4)

Step 1) In the next screen scroll down to find the position button and click on it

Step 2) Enter the company code that we defined previously

Press Enter

Now we can find the Account Group, name, From Account and To Account details of the G/L accounts to be created

G/L Creation (Use Transaction code - FS00)

A. SBI Rupees term loan

Step 1) Give the G/L account number, Company code and press With Template button in order to create a new G/L account with reference to another G/L account

Step 2) Enter the G/L (Equity share capital ) and Company code

Press enter

Step 3) Change the Account group to Secured Loans, change the short and long text.

Select Create/bank/interest tab

Step 4) Field status group change to G005

Interest Indicator select M1

Step 5) Select save button

we get message below

we get message belowB. Interest Account

Step 1) Give the G/L account number, Company code and press With Template button in order to create a new G/L account with reference to another G/L account

Step 2) Enter the G/L (Salaries Account ) and Company code

Press enter

Step 3) Select Type/Description tab

Change the Account group to Interest, change the short and long text

Other fields common

Step 4) Select save button

we get message below

we get message belowAssignment Accounts for Automatic Postings

Path: SPRO - Select SAP Reference IMG - Financial Accounting - General Ledger Accounting - Business Transactions - Bank Account Interest Calculation - Interest Posting - Prepare G/L Account Balance Interest Calculation (Transaction code is OB83 )

Step 1) Select the Symbols button

Step 2) Note interest paid - 0002 and G/L account (paid) - 2000

Select Accounts button

Step 3) Give the Chart of Accounts MML and press enter

Step 4) Populate the following fields: Account symbol, Currency and G/L Account

Note: 10 times + means any account number

Why 10 times + (plus) if we are using 6 digits for G/L account? Why not use ++++++ (6 times plus) ? Because even though G/L is 6 digits sap adds four zero to make it 10 digits Example : 400400 ( 0000400400)

Step 4) Select save button

we get message below

we get message belowEnd User Area

SBI rupee term loan receipt - (F-02)

SBI cheque date 10.04.2017

cheque deposit in bank 12.04.2017

Document and Posting date 12.04.2017

Interest calculation in SAP from 12.04.2017

whereas bank calculates from 10.04.2017

we are giving value date 10.04.2107

Now Sap also calculates interest from 10.04.2018

Step 1) Populate the following fields: Document Date, Type, Company Code, Period, Currency and Posting key. Select the G/L account from the drop down button and press enter

Step 2) Populate the following fields: Amount, Business Area, Value date, Text, Posting key, Account in the next screen and press enter

Step 3) Populate the following fields: Amount, Business Area, Value date, Text in the next screen and press enter

Step 4) From the menu select document and press simulate to view the document details

Step 5) Select save button

we get message below

we get message belowTerm loan repayment (Use t.code f-02)

Due date 10.09.2017

Cheque date 07.09.2017

Value date 10.09.2017

Document and Posting date 07.09.2017

Step 1) Populate the following fields: Document Date, Type, Company Code, Period, Currency and Posting key. Select the G/L account from the drop down button and press enter

Step 2) Populate the following fields: Amount, Business Area, Value date, Text, Posting key, Account in the next screen and press enter

Step 3) Populate the following fields: Amount, Business Area, Value date, Text in the next screen and press enter

Step 4) From the menu select document and press simulate to view the document details

Step 5) Select save button

we get message below

we get message belowBalance Interest Calculation

Path: Accounting - Financial Accounting - General Ledger -Periodic Processing - Interest Calculation - Balance Interest Calculation (Transaction code is f.52)

Populate the following fields: Chart of Accounts, Company code, G/L account and Calculation period Select additional balance line check box

Execute

Here we view Interest rate and Interest

(100000*10%*153/365 days = 4,191.78

90000*10%*203/365 days = 5,005.48)

Interest Rates Changed

Interest rate change from 10% to 12% from 01.06.2017

On 100000 from 10.04.2017 to 31.05.2017 @ 10%

On 100000 from 01.06.2017 to 09.09.2017 @ 12%

On 90000 form 10.09.2017 to 31.03.2018 @ 12%

Enter Interest rate(new) - (transaction code is OB83)

Step 1) Select New Entries button

Step 2) Populate the following fields: Reference, Valid from and Interest rate

Step 3) Select save button

we get message below

we get message belowBalance Interest Calculation (when rate changed)

(transaction code is f.52)

Populate the following fields : Chart of Accounts, Company code, G/L account and Calculation period Select additional balance line check box

Execute

Here we view Interest rate and Interest

(100000*10%*52/365 days = 1,424.66

100000*12%*101/365 days = 3320.55

90000*12%*203/365 days = 6006.58)

Interest Postings to Accounts (one month) (Transaction code is f.52)

Step 1) Populate the following fields: Chart of Accounts, Company code, G/L account and Calculation period

Select Post interest settlements check box and update master records check box

Session name :MML

Posting to business area : MMLH

Posting date of session : 30.04.2017

Posting segment text : Interest for April 2017

Select Execute button

Here we can see Interest for a month (100000*10%*21/365 days)

Step 2) To view the batch Input session From the menu select System - Services - Batch input - Session

Step 3) Select the Session name and press process button

Step 3) Select the Session name and press process buttonStep 4) Select Display errors only radio button and press process button

Step 5) We get message Processing of batch input session completed

To view the Document Posted (Use transaction code - FB03)

Go and see the G/L master (Transaction code is FS00)

Step 1) Give G/L account and company code

Select Display button

Step 2) Select Create/bank/interest tab

Here we see Key date of last interest calculation and Date of last interest run