Foreign Currency Balance Revaluation

Company has taken loan from SBI FC Term loan USD worth 1,00,000 on 31.07.2017 and not paid until 31.03.2018

31.07.2017 : INR 60,00,000 (USD 1,00,000 * INR 60)

31.03.2018 : INR 64,00,000 (USD 1,00,000 * INR 64)

There is Exchange loss of INR 4,00,000 (INR 64,00,000 - INR 60,00,000)

Exchange loss should be transferred to P&L Account.

Customization of Foreign Currency Revaluation

Steps:

1. Creation of 3 G/L Masters

2. Define Account Principles

3. Assign Accounting Principle to Ledger Groups

4. Define Valuation Methods

5. Define Valuation Areas

6. Assign Valuation Areas and Accounting Principles

7. Prepare Automatic Posting for Foreign Currency Valuation

8. Delete Ledgers Assigned to Ledger Group OL other than OL

9. Assign Exchange rate difference key in G/L master

End User Area

Steps:

1. Foreign Currency Term Loan Receipt

2. Enter Year End Exchange Rates in Forex Table

3. Foreign Currency Revaluation

Creation of 3 G/L Masters

A) SBI FC Term loan - Secured loans

B) Exchange Gain - Other Income

C) Exchange Loss - Administration

To check account group for the accounts to be created follow the following path

Path: SPRO - Select SAP Reference IMG - Financial Accounting - General Ledger Accounting - GL accounts - Master Data - Preparation - Define Account Group (transaction code is OBD4)

Step 1) In the next screen scroll down to find the position button and click on it

Step 2) Enter the company code that we defined previously

Press Enter

Now we can find the Account Group, name, From Account and To Account details of the G/L accounts to be created SBI FC Term Loan

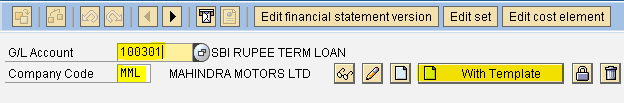

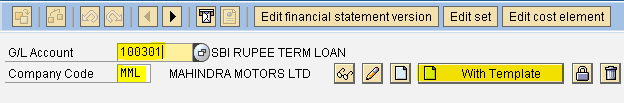

Step 1) Give the G/L account number, Company code and press With Template button in order to create a new G/L account with reference to another G/L account

Step 2) Enter the G/L we created previously (SBI Rupee Term loan) and Company code

Press enter

Step 3) Change the short and long text and select Control Data tab

Step 4) Account Currency change to USD

Deselect Only balances in local currency check box

Select Create/bank/interest tab

Step 5) Interest indicator: Blank Delete the Dates

Step 6) Select save button we get message below

we get message below

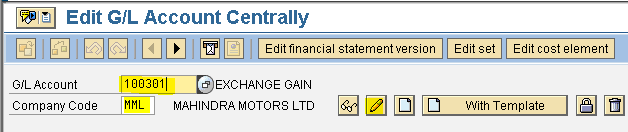

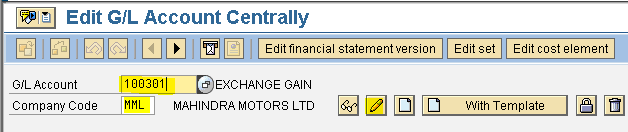

Exchange Gain

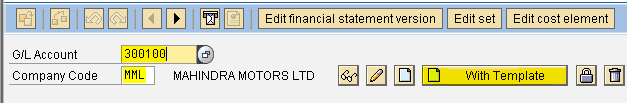

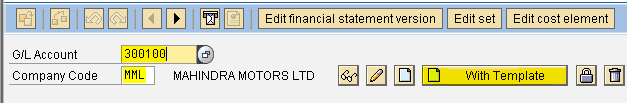

Step 1) Give the G/L account number, company code and press With Template button in order to create a new G/L account with reference to another G/L account

Step 2) Enter the G/L we created previously (SBI Rupee Term loan) and Company code

Press enter

Step 3) Change account group

Change short and long text

Step 4) Select save button we get message below

we get message below

Exchange Loss

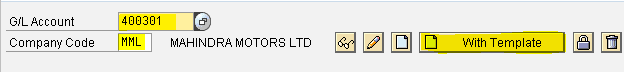

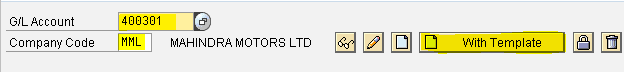

Step 1) Give the G/L account number, Company code and press With Template button in order to create a new G/L account with reference to another G/L account

Step 2) Enter the G/L we created previously (SBI Rupee Term loan) and Company code

Press enter

Step 3) Change short and long text

Step 4) Select save button we get message below

we get message below

Define Account Principles

Path: SPRO - Select SAP Reference IMG - Financial Accounting (new) - Financial Accounting Global Setting (new) - Ledgers - Parallel Accounting - Define Accounting Principles

Select the menu path

Step 1) Select New Entries button

Populate the fields Accounting Principle and Name/Description of Accounting Principle

Step 2) Select save button we get message below

get message below

Assign Accounting Principle to Ledger Groups

Path: SPRO - Select SAP Reference IMG - Financial Accounting (new) - Financial Accounting Global Setting (new) - Ledgers - Parallel Accounting - Assign Accounting Principle to Ledger Groups

Step 1) Select New Entries button

Give the Accounting principle defined and select Target ledger group from the drop down menu

Step 2) Select save button we get message below

we get message below

Define Valuation Methods

Path: SPRO - Select SAP Reference IMG - Financial Accounting (new) - General Ledger Accounting (new) - Periodic Processing - Valuate - Define Valuation Methods

Step 1) Select New Entries button

Populate the fields Valuation method and Description

Select always evaluate radio button

Document type : SA

Exchange rate type for debit balance : B (bank selling rate)

Exchange rate type for credit balance : B (bank selling rate)

Select Determine exchange rate type from account balance

Step 2) Select save button we get message below

we get message below

Define Valuation Areas

Path: SPRO - Select SAP Reference IMG - Financial Accounting (new) - General Ledger Accounting (new) - Periodic Processing - Valuate - Define Valuation Areas

Step 1) Select New Entries button

Populate the fields Valuation and Valuation method Currency type: Select Company code currency from the drop down menu

Step 3) Select save button we get message below

we get message below

Assign Valuation Areas and Accounting Principles

Path: SPRO - Select SAP Reference IMG - Financial Accounting (new) - General Ledger Accounting (new) - Periodic Processing - Valuate - Assign Valuation Areas and Accounting Principles

Step 1) Select New Entries button

Populate the fields Valuation Area and Accounting Principle

Step 2) Select save button we get message below

we get message below

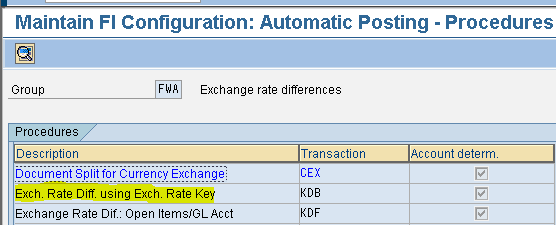

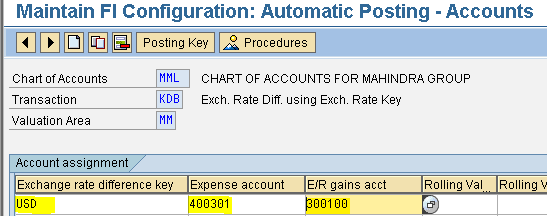

Prepare Automatic Posting for Foreign Currency Valuation

Path: SPRO - Select SAP Reference IMG - Financial Accounting (new) - General Ledger Accounting (new) - Periodic Processing - Valuate - Foreign Currency Valuation - Prepare Automatic Postings for Foreign Currency Valuation (Transaction code is OBA1)

Step 1) Double click Exchange rate difference using exchange rate key

Step 2) Give Chart of Accounts and select right arrow button (change valuation area)

Step 3) Give Valuation Area and press enter

Step 4) Enter the Exchange rate difference key

Choose Expenses account from the drop down menu

Choose Exchange rate gain account from the drop down menu

Step 5) Select save button we get message below

we get message below

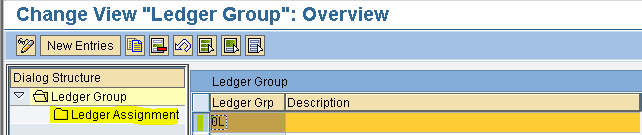

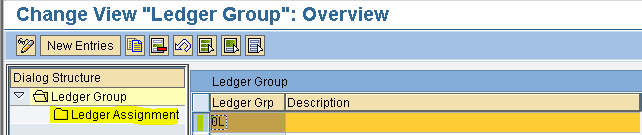

Delete Ledgers Assigned to Ledger Group OL other than OL

Path: SPRO - Select SAP Reference IMG - Financial Accounting (new) - Financial Accounting Global Settings (new) - Ledgers - Ledger - Define Ledger Group

Select Ledger group 0L and double click Ledger Assignment folder

Select ledgers other than 0L

Save

Assign Exchange rate difference key in G/L master (FS00)

Step 1) Give G/L account 100301 SBI FC Term loan and Company code

Select Change button

Step 2) Select Control Data tab

Exchange rate difference key select USD from drop down menu

Step 3) Select save button we get message below

we get message below

End User Area

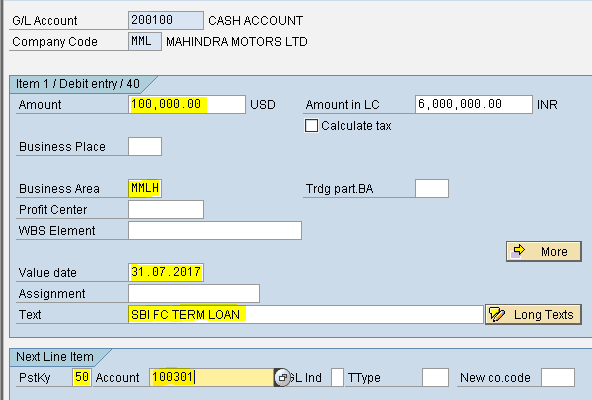

Foreign Currency Term Loan Receipt (F-02)

Step 1) Populate the following fields: Document date, Type, Company code, Currency/Rate, posting Key and Account Ignore warning message

Press enter

Step 2) Populate the following fields: Amount, Business area, Value date, Text (press enter to view Amount in Local Currency), Posting key and Account

Press enter

Step 3) Populate the following fields: Amount, Business area, Value date and Text

Step 4) Form the menu Document - Simulate

To view in INR press the Display Currency button

Step 5) Select save button we get message below

we get message below

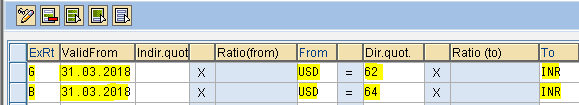

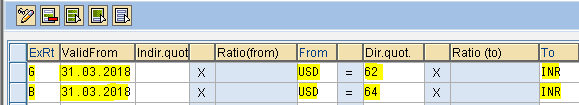

Enter Year End Exchange Rates in Forex Table (Transaction code is OB08)

Step 1) Select New Entries button

Populate the fields : Exchange rate (select from drop down), Valid from, From, Direct quotation and To

Step 2) Select save button we get message below

we get message below

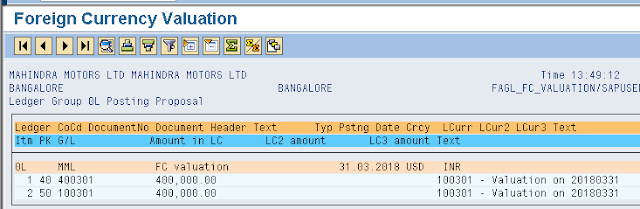

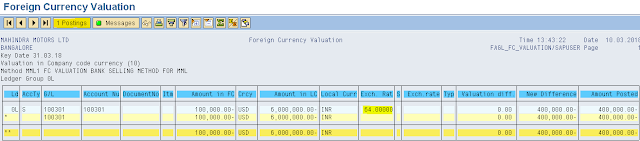

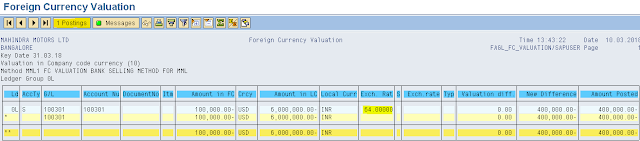

Foreign Currency Revaluation

Path: Accounting - Financial Accounting - General Ledger - Periodic Processing - Closing - Valuate - Foreign Currency Valuation (new) (Transaction code is FAGL_FC_VAL)

Step 1) Give Company code, Valuation key date and Valuation Area

Select G/L balance tab

Select Valuate G/L Account Balances check box

Give G/L Account (SBI FC Term Loan)

Step 2) Select Postings tab and give batch input session name

Select execute button

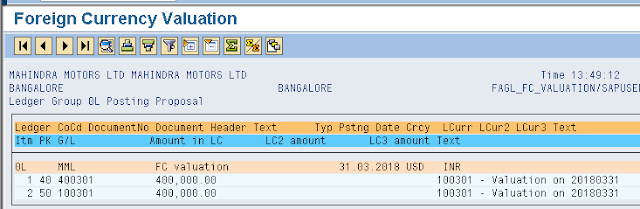

Step 3) Select 1 Postings button

Here we find exchange loss account debit and SBI FC term loan account credit

Company has taken loan from SBI FC Term loan USD worth 1,00,000 on 31.07.2017 and not paid until 31.03.2018

31.07.2017 : INR 60,00,000 (USD 1,00,000 * INR 60)

31.03.2018 : INR 64,00,000 (USD 1,00,000 * INR 64)

There is Exchange loss of INR 4,00,000 (INR 64,00,000 - INR 60,00,000)

Exchange loss should be transferred to P&L Account.

Customization of Foreign Currency Revaluation

Steps:

1. Creation of 3 G/L Masters

2. Define Account Principles

3. Assign Accounting Principle to Ledger Groups

4. Define Valuation Methods

5. Define Valuation Areas

6. Assign Valuation Areas and Accounting Principles

7. Prepare Automatic Posting for Foreign Currency Valuation

8. Delete Ledgers Assigned to Ledger Group OL other than OL

9. Assign Exchange rate difference key in G/L master

End User Area

Steps:

1. Foreign Currency Term Loan Receipt

2. Enter Year End Exchange Rates in Forex Table

3. Foreign Currency Revaluation

Creation of 3 G/L Masters

A) SBI FC Term loan - Secured loans

B) Exchange Gain - Other Income

C) Exchange Loss - Administration

To check account group for the accounts to be created follow the following path

Path: SPRO - Select SAP Reference IMG - Financial Accounting - General Ledger Accounting - GL accounts - Master Data - Preparation - Define Account Group (transaction code is OBD4)

Step 1) In the next screen scroll down to find the position button and click on it

Step 2) Enter the company code that we defined previously

Press Enter

Now we can find the Account Group, name, From Account and To Account details of the G/L accounts to be created SBI FC Term Loan

Step 1) Give the G/L account number, Company code and press With Template button in order to create a new G/L account with reference to another G/L account

Step 2) Enter the G/L we created previously (SBI Rupee Term loan) and Company code

Press enter

Step 3) Change the short and long text and select Control Data tab

Step 4) Account Currency change to USD

Deselect Only balances in local currency check box

Select Create/bank/interest tab

Step 5) Interest indicator: Blank Delete the Dates

Step 6) Select save button

we get message below

we get message belowExchange Gain

Step 1) Give the G/L account number, company code and press With Template button in order to create a new G/L account with reference to another G/L account

Step 2) Enter the G/L we created previously (SBI Rupee Term loan) and Company code

Press enter

Step 3) Change account group

Change short and long text

Step 4) Select save button

we get message below

we get message belowExchange Loss

Step 1) Give the G/L account number, Company code and press With Template button in order to create a new G/L account with reference to another G/L account

Step 2) Enter the G/L we created previously (SBI Rupee Term loan) and Company code

Press enter

Step 3) Change short and long text

Step 4) Select save button

we get message below

we get message belowDefine Account Principles

Path: SPRO - Select SAP Reference IMG - Financial Accounting (new) - Financial Accounting Global Setting (new) - Ledgers - Parallel Accounting - Define Accounting Principles

Step 1) Select New Entries button

Populate the fields Accounting Principle and Name/Description of Accounting Principle

Step 2) Select save button we

get message below

get message belowAssign Accounting Principle to Ledger Groups

Path: SPRO - Select SAP Reference IMG - Financial Accounting (new) - Financial Accounting Global Setting (new) - Ledgers - Parallel Accounting - Assign Accounting Principle to Ledger Groups

Step 1) Select New Entries button

Give the Accounting principle defined and select Target ledger group from the drop down menu

Step 2) Select save button

we get message below

we get message belowDefine Valuation Methods

Path: SPRO - Select SAP Reference IMG - Financial Accounting (new) - General Ledger Accounting (new) - Periodic Processing - Valuate - Define Valuation Methods

Step 1) Select New Entries button

Populate the fields Valuation method and Description

Select always evaluate radio button

Document type : SA

Exchange rate type for debit balance : B (bank selling rate)

Exchange rate type for credit balance : B (bank selling rate)

Select Determine exchange rate type from account balance

Step 2) Select save button

we get message below

we get message belowDefine Valuation Areas

Path: SPRO - Select SAP Reference IMG - Financial Accounting (new) - General Ledger Accounting (new) - Periodic Processing - Valuate - Define Valuation Areas

Step 1) Select New Entries button

Populate the fields Valuation and Valuation method Currency type: Select Company code currency from the drop down menu

Step 3) Select save button

we get message below

we get message belowAssign Valuation Areas and Accounting Principles

Path: SPRO - Select SAP Reference IMG - Financial Accounting (new) - General Ledger Accounting (new) - Periodic Processing - Valuate - Assign Valuation Areas and Accounting Principles

Step 1) Select New Entries button

Populate the fields Valuation Area and Accounting Principle

Step 2) Select save button

we get message below

we get message belowPrepare Automatic Posting for Foreign Currency Valuation

Path: SPRO - Select SAP Reference IMG - Financial Accounting (new) - General Ledger Accounting (new) - Periodic Processing - Valuate - Foreign Currency Valuation - Prepare Automatic Postings for Foreign Currency Valuation (Transaction code is OBA1)

Step 1) Double click Exchange rate difference using exchange rate key

Step 2) Give Chart of Accounts and select right arrow button (change valuation area)

Step 3) Give Valuation Area and press enter

Step 4) Enter the Exchange rate difference key

Choose Expenses account from the drop down menu

Choose Exchange rate gain account from the drop down menu

Step 5) Select save button

we get message below

we get message belowDelete Ledgers Assigned to Ledger Group OL other than OL

Path: SPRO - Select SAP Reference IMG - Financial Accounting (new) - Financial Accounting Global Settings (new) - Ledgers - Ledger - Define Ledger Group

Select Ledger group 0L and double click Ledger Assignment folder

Select ledgers other than 0L

Save

Assign Exchange rate difference key in G/L master (FS00)

Step 1) Give G/L account 100301 SBI FC Term loan and Company code

Select Change button

Step 2) Select Control Data tab

Exchange rate difference key select USD from drop down menu

Step 3) Select save button

we get message below

we get message belowEnd User Area

Foreign Currency Term Loan Receipt (F-02)

Step 1) Populate the following fields: Document date, Type, Company code, Currency/Rate, posting Key and Account Ignore warning message

Press enter

Step 2) Populate the following fields: Amount, Business area, Value date, Text (press enter to view Amount in Local Currency), Posting key and Account

Press enter

Step 3) Populate the following fields: Amount, Business area, Value date and Text

Step 4) Form the menu Document - Simulate

To view in INR press the Display Currency button

Step 5) Select save button

we get message below

we get message belowEnter Year End Exchange Rates in Forex Table (Transaction code is OB08)

Step 1) Select New Entries button

Populate the fields : Exchange rate (select from drop down), Valid from, From, Direct quotation and To

Step 2) Select save button

we get message below

we get message belowForeign Currency Revaluation

Path: Accounting - Financial Accounting - General Ledger - Periodic Processing - Closing - Valuate - Foreign Currency Valuation (new) (Transaction code is FAGL_FC_VAL)

Step 1) Give Company code, Valuation key date and Valuation Area

Select G/L balance tab

Select Valuate G/L Account Balances check box

Give G/L Account (SBI FC Term Loan)

Step 2) Select Postings tab and give batch input session name

Select execute button

Step 3) Select 1 Postings button

Here we find exchange loss account debit and SBI FC term loan account credit