Assignment of Accounts for Automatic Postings

The G/L accounts assigned will get linked to asset class

Path: SPRO - Select SAP reference IMG - Financial Accounting - Asset Accounting - Integration with General Ledger - Assign G/L Accounts (transaction code is AO90)

In the menu path select

Step 1) Select Chart of Accounts MML

Double click on Account Determination folder

Step 2) Select Account determination MML10000

Double click on Balance Sheet Accounts folder

Step 3) Acquisition and production costs give account number 200000 (land)

Loss made on asset retirement w/o revenue - 400303

Clearing account revenue from asset sale - 300102

Gain from asset sale - 300103

Loss form asset sale - 400302

Save

Ignore warning message press enter

We receive a message below

Step 4) Double click on Account Determination folder in the same screen

in the same screen

Select account determination MML11000

Double click on Balance Sheet Accounts folder

Step 5) Acquisition and production costs give account number 200005 (building)

Loss made on asset retirement w/o revenue - 400303

Clearing account revenue from asset sale - 300102

Gain from asset sale - 300103

Loss form asset sale - 400302

Step 6) Double click on Depreciation folder in the same screen

in the same screen

Accumulated depreciation account for ordinary depreciation - 100200

Expenses account for ordinary depreciation

Save

Ignore the message press enter

We receive a message below

Step 7) Double click on Account Determination folder in the same screen

in the same screen

Select account determination MML20000

Double click on Balance Sheet Accounts folder

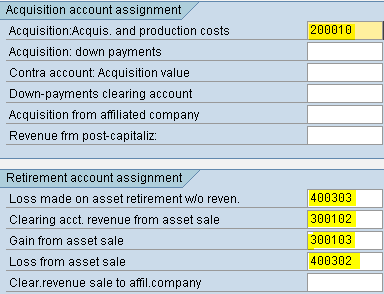

Step 8) Acquisition and production costs give account number 200010 (plant and machinery)

Loss made on asset retirement w/o revenue - 400303

Clearing account revenue from asset sale - 300102

Gain from asset sale - 300103

Loss form asset sale - 400302

Step 9) Double click on Depreciation folder in the same screen

in the same screen

Accumulated depreciation account for ordinary depreciation - 100205

Expenses account for ordinary depreciation

Save

Step 10) Double click on Account Determination folder in the same screen

in the same screen

Select account determination MML30000

Double click on Balance Sheet Accounts folder

Step 11) Acquisition and production costs give account number 200015 (furnitures and fixtures)

Loss made on asset retirement w/o revenue - 400303

Clearing account revenue from asset sale - 300102

Gain from asset sale - 300103

Loss form asset sale - 400302

Step 12) Double click on Depreciation folder in the same screen

in the same screen

Accumulated depreciation account for ordinary depreciation - 100210

Expenses account for ordinary depreciation

Save

Step 13) Double click on Account Determination folder in the same screen

in the same screen

Select account determination MML31000

Double click on Balance Sheet Accounts folder

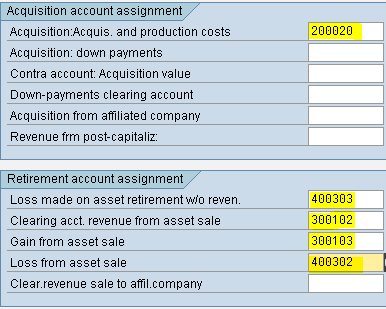

Step 14) Acquisition and production costs give account number 200020 (vehicles and others)

Loss made on asset retirement w/o revenue - 400303

Clearing account revenue from asset sale - 300102

Gain from asset sale - 300103

Loss form asset sale - 400302

Step 15) Double click on Depreciation folder in the same screen

in the same screen

Accumulated depreciation account for ordinary depreciation - 100215

Expenses account for ordinary depreciation

Save

Step 16) Double click on Account Determination folder in the same screen

in the same screen

Select account determination MML40000

Double click on Balance Sheet Accounts folder

Step 17) Acquisition and production costs give account number 200025 (capital work in progress)

Loss made on asset retirement w/o revenue - 400303

Clearing account revenue from asset sale - 300102

Gain from asset sale - 300103

Loss form asset sale - 400302

Save

The G/L accounts assigned will get linked to asset class

Path: SPRO - Select SAP reference IMG - Financial Accounting - Asset Accounting - Integration with General Ledger - Assign G/L Accounts (transaction code is AO90)

In the menu path select

Step 1) Select Chart of Accounts MML

Double click on Account Determination folder

Step 2) Select Account determination MML10000

Double click on Balance Sheet Accounts folder

Step 3) Acquisition and production costs give account number 200000 (land)

Loss made on asset retirement w/o revenue - 400303

Clearing account revenue from asset sale - 300102

Gain from asset sale - 300103

Loss form asset sale - 400302

Save

Ignore warning message press enter

We receive a message below

Step 4) Double click on Account Determination folder

in the same screen

in the same screenSelect account determination MML11000

Double click on Balance Sheet Accounts folder

Step 5) Acquisition and production costs give account number 200005 (building)

Loss made on asset retirement w/o revenue - 400303

Clearing account revenue from asset sale - 300102

Gain from asset sale - 300103

Loss form asset sale - 400302

Step 6) Double click on Depreciation folder

in the same screen

in the same screenAccumulated depreciation account for ordinary depreciation - 100200

Expenses account for ordinary depreciation

Save

Ignore the message press enter

We receive a message below

Step 7) Double click on Account Determination folder

in the same screen

in the same screenSelect account determination MML20000

Double click on Balance Sheet Accounts folder

Step 8) Acquisition and production costs give account number 200010 (plant and machinery)

Loss made on asset retirement w/o revenue - 400303

Clearing account revenue from asset sale - 300102

Gain from asset sale - 300103

Loss form asset sale - 400302

Step 9) Double click on Depreciation folder

in the same screen

in the same screenAccumulated depreciation account for ordinary depreciation - 100205

Expenses account for ordinary depreciation

Save

Step 10) Double click on Account Determination folder

in the same screen

in the same screenSelect account determination MML30000

Double click on Balance Sheet Accounts folder

Step 11) Acquisition and production costs give account number 200015 (furnitures and fixtures)

Loss made on asset retirement w/o revenue - 400303

Clearing account revenue from asset sale - 300102

Gain from asset sale - 300103

Loss form asset sale - 400302

Step 12) Double click on Depreciation folder

in the same screen

in the same screenAccumulated depreciation account for ordinary depreciation - 100210

Expenses account for ordinary depreciation

Save

Step 13) Double click on Account Determination folder

in the same screen

in the same screenSelect account determination MML31000

Double click on Balance Sheet Accounts folder

Step 14) Acquisition and production costs give account number 200020 (vehicles and others)

Loss made on asset retirement w/o revenue - 400303

Clearing account revenue from asset sale - 300102

Gain from asset sale - 300103

Loss form asset sale - 400302

Step 15) Double click on Depreciation folder

in the same screen

in the same screenAccumulated depreciation account for ordinary depreciation - 100215

Expenses account for ordinary depreciation

Save

Step 16) Double click on Account Determination folder

in the same screen

in the same screenSelect account determination MML40000

Double click on Balance Sheet Accounts folder

Step 17) Acquisition and production costs give account number 200025 (capital work in progress)

Loss made on asset retirement w/o revenue - 400303

Clearing account revenue from asset sale - 300102

Gain from asset sale - 300103

Loss form asset sale - 400302

Save