Creating G/L Masters (Use t-code FS00)

1. Sundry debtors (Bills of Exchange)

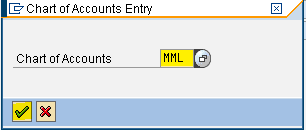

Step 1) Give the G/L account number, company code and press With Template button in order to create a new G/L account with reference to another G/L account

Step 2) Enter the G/L we created previously (Sundry Debtors) and Company code

Press Enter

Step 3) Change the short and long text.

Other fields are common

Step 4) Select the save button we get a message below

we get a message below

2. SBI bill discounting

Step 1) Give the G/L account number, company code and press With Template button in order to create a new G/L account with reference to another G/L account

Step 2) Enter the G/L we created previously (SBI rupee term loan) and Company code

Press Enter

Step 3) Change the short and long text.

Select Control data tab

Step 4) Select Open item management checkbox

Select Create/bank/interest tab

Select Post automatically checkbox

Step 5) Select the save button we get a message below

we get a message below

1. Sundry debtors (Bills of Exchange)

Step 1) Give the G/L account number, company code and press With Template button in order to create a new G/L account with reference to another G/L account

Step 2) Enter the G/L we created previously (Sundry Debtors) and Company code

Press Enter

Step 3) Change the short and long text.

Other fields are common

Step 4) Select the save button

we get a message below

we get a message below2. SBI bill discounting

Step 1) Give the G/L account number, company code and press With Template button in order to create a new G/L account with reference to another G/L account

Step 2) Enter the G/L we created previously (SBI rupee term loan) and Company code

Press Enter

Step 3) Change the short and long text.

Select Control data tab

Step 4) Select Open item management checkbox

Select Create/bank/interest tab

Select Post automatically checkbox

Step 5) Select the save button

we get a message below

we get a message below